BondHub™

Fixed Income Data Integration Platform

As competition in the marketplace increases and regulatory reporting times decrease, fixed income trading firms must automate and improve their efficiency or they will be left behind. Traders want to maximize exposure of fixed income quotes and RFQs across multiple trading venues while maintaining the ability to execute instantaneously without the risk of overselling inventory. They want choices for security reference data and pricing vendors. They want to see market orders, quotes, and RFQs collected in one place. The operations staff wants trades to automatically flow through to the clearing vendor to meet reporting and compliance requirements. And, management wants to see increased trading volume and higher profits.

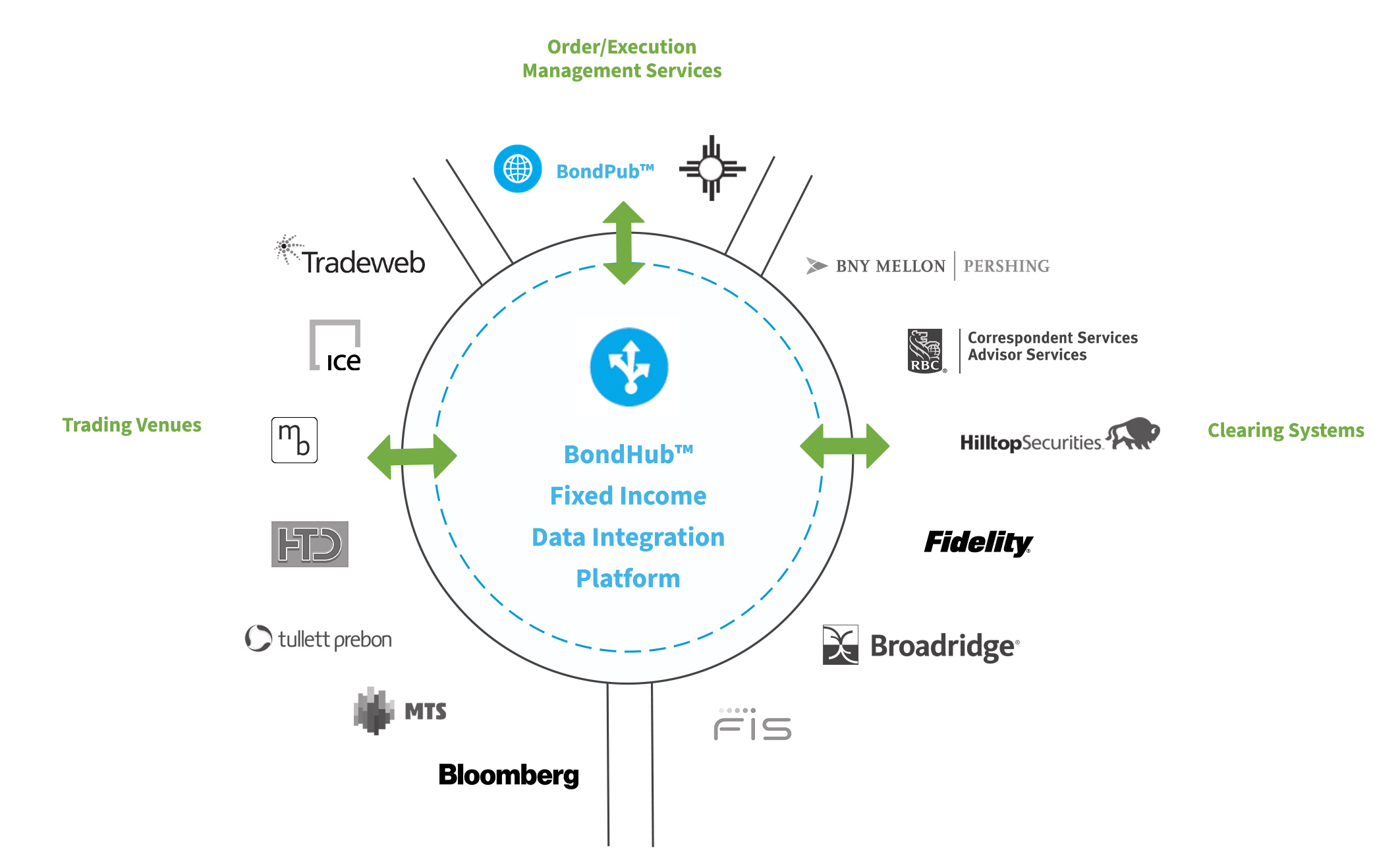

Responding to these challenges often requires integration and interaction between multiple computer systems – both internal and external to the firm. The solution to this fixed income electronic trading problem is our bond trading platform, BondHub. BondHub acts as an Integration As A Service (IAAS) platform for the bond market – centralizing access to electronic trading, clearing vendors’ trade reporting, reference data sources, and historical and evaluated pricing data sources.

Primary uses of the BondHub service portal currently include:

- Publish Quotes (bids & offers)

- Publish RFQs (bids wanted & offers wanted)

- Publish Trade Reports

- Publish / Receive Trade Notification (Drop-Copy)

- Execute Orders (at list, negotiated)

- Receive Market Quotes

- Receive Market RFQs

- Receive Security Reference Data*

- Receive Historical Trade Pricing*

- Receive Evaluated Security Pricing*

Enterprise System Integration

Product Overview

BondHub supports a variety of standard and proprietary communication protocols to interact with the various sources – including API, which uses the Financial Information Exchange (FIX) protocol, SOAP, and others. Internal messaging protocols or proprietary data formats that are used by connected systems are translated into or out of their native protocol as necessary. Additionally, our WebSocket API is used to communicate with our BondPub™ system along with other external dealer systems. This architecture allows the flexibility for our clients to communicate freely with all sources using a single BondHub API rather than dealing with the disparate protocols of each different source.

Publish Quotes (bid & offers)

Example:

An offering quote is published and a ‘list price’ bid is received from one ATS.

The BondHub server ensures that an updated offering quote for a reduced quantity is immediately sent to all ATS’s so that the position is not oversold. Then, the system either auto-accepts the order or delivers the bid to the trader’s desk for manual confirmation.

Publish RFQs (bids wanted & offers wanted)

Publish Trade Reports

A component of the BondHub service portal, referred to as the clearing gateway, is used to communicate with the various clearing vendors. The clearing gateway translates the trade message to the proprietary communication protocol used by the firm’s clearing provider (for example, Pershing’s UTF format) and routes to the clearing firm for processing. Acknowledgments and other alerts messages from the clearing provider are translated and routed back to the trader for storage or processing locally.

Publish/Receive Trade Notification (Drop-Copy)

Execute Orders (at list, negotiated)

Receive Market Quotes

Receive Market RFQs

Receive Security Reference Data

Receive Historical Trade or Evaluated Security Pricing